Top 5 Financial New Year's Resolutions for 2026

Getting more exercise

Following a healthy diet

Focusing on self-care

Reading more books…are some of the most common New Year’s resolutions you might be making for several years in a row!

When just a few days are left for the arrival of New Year, you might be reflecting on the year gone by, and resolutions to make for the upcoming year. Amidst all these, did you forget an essential sphere of life you must have taken seriously? What about your finances that would be funding many of your New Year Resolutions?

‘Save more money’ is the third most common New Year’s Resolution. However, if you had made any resolution concerning your finances last year, you must know how difficult it is to fulfill.

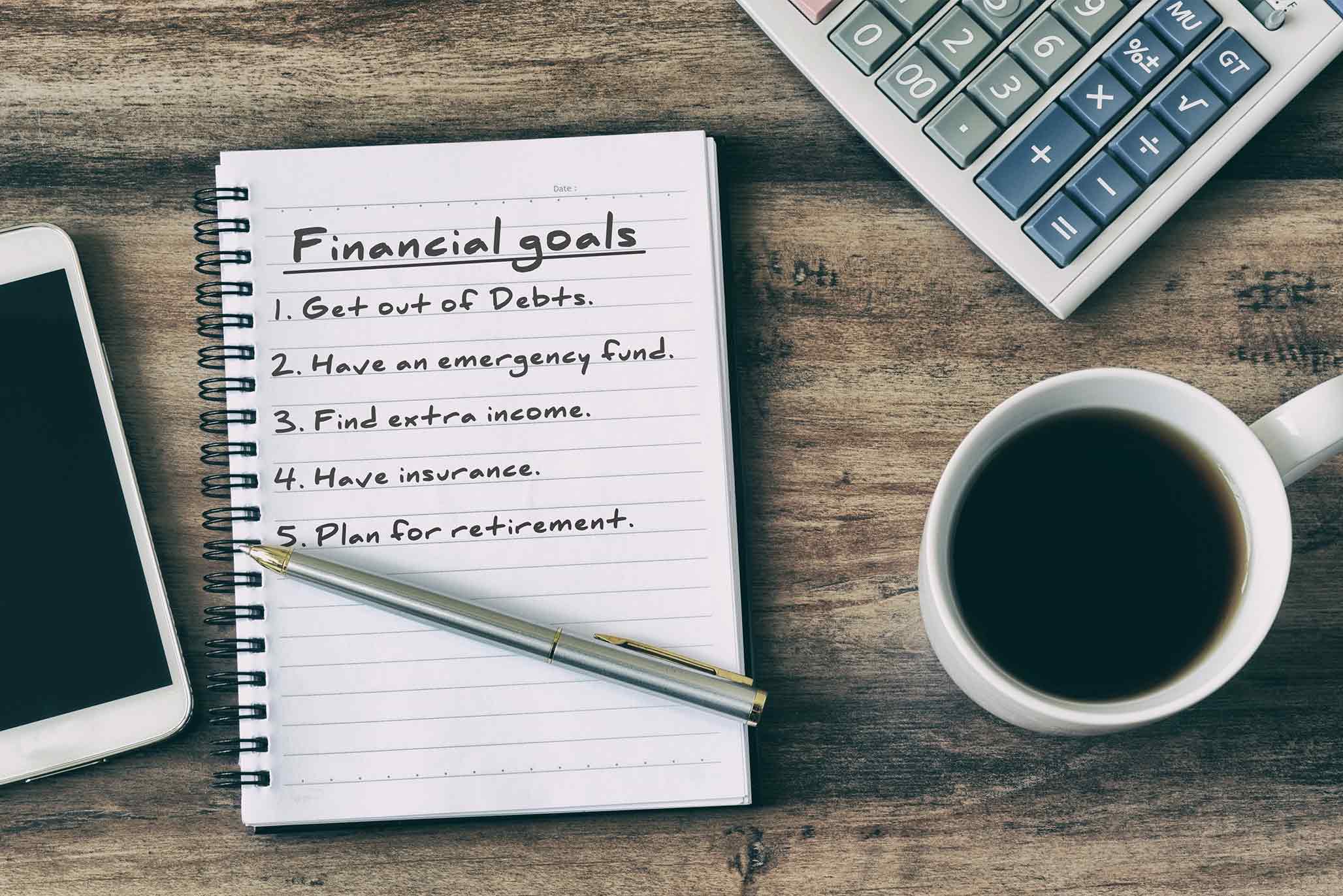

5 Financial New Year's Resolutions

The good news is you can still take control of your finances and make your financial New Year's resolutions achievable with these Five Vows!

1. Get out of debt

Reducing your debt should be the first crucial step to taking control of your finances. By focusing on this financial vow, you can significantly reduce the amount you pay in interest. The incredible feeling of going debt-free is another perk you get. Moreover, you get more financial freedom to plan many things you may be dreaming for several years, like an overseas trip. The money you will save on interests can be used to invest and grow. It will indeed take some sacrifice and tough decisions to make it happen, but it will be worth the effort. You can start by making a specific goal on how much debt you want to get rid of this year. Take account of your income and amount of debt into consideration to create a foolproof plan to go debt free, or at least reduce it. Set a number for every month and start working to fulfill this resolution.

Also Read: Most Famous and Popular Resolutions: What’s Yours?

2. Don’t just save but invest wisely

When there are a plethora of investment options available, it doesn’t make sense to let your money go stale in your salary account. Saving money is good, but the smartest thing you can do is to let it grow through smart investment options. For example, you can boost your financial plans with wealth builder plans which not only double your money for defined financial milestones, but also take care of your family in case you are not around. Other perks of wealth builder plans are:

- Guaranteed protection for your family in case of your death

- Flexibility in choosing premium payment and policy terms

- Tax benefits at the time of investment as well as maturity, for regular premium policies

Ideally, you should incorporate multiple investment pillars to create a strong financial ground, for example, PPF, FDs, SIPs, real estate, etc. Investing money in multiple investment channels helps in securing your finances.

Also Read: How to Maintain a Good Work Life Balance in India?

3. Make your finances foolproof with the right insurance products

Life is uncertain, and miseries often knock your door when you least expect them. You may have several financial priorities in your life, but amidst all these, you can’t overlook the importance of securing the future of yourself and your loved ones. Though insurance products don’t give you lucrative returns, it creates a fail-safe safety net for your family. You must be prepared for uncertain events in life with the right insurance tools. How you can do so:

- Purchase a term insurance plan to take care of the debts and expenditures in your absence. It is an indispensable financial backup every person must have.

- If you are already covered with a health insurance policy, you can consider increasing the coverage through top-up plans.

- Opt for child plans to take care of your child’s dream, education or marriage.

4. Create an emergency fund

Every family must build an emergency fund to combat unexpected rainy days. The size of your emergency fund depends significantly on your current income, family members, number of earning members in your family, and assets you own. If you are still getting out of debt, you can start with a smaller emergency fund. Once you pay off debt, focus on increasing it. Also, ask every earning member of your family to contribute to this fund. Ideally, your emergency fund should be large enough to fuel your monthly expenses for at least six months and it should be liquid.

5. Build a fail-safe retirement plan

Your job might not be offering a retirement package and so the time to stock for a worry-free retirement is NOW. Every person wants to enjoy the same lifestyle you are currently living after retirement. Start planning it now and be realistic about it. Estimate your needs, health issues, unpredictable expenses, your age, salary, current financial liabilities and inflation in your computations. With the increase in salary, contribute more to your retirement plan so that you can retire rich.

The current year has come to its conclusion, and it is that time of year you may be making plans for New Year. Making resolutions for physical health and weight loss is good, but you can’t overlook the massive role money plays in our lives. A penny saved is a penny earned, and so you can’t neglect your finances. For a happier and more secure tomorrow, take these five financial new year's resolutions and don’t let them go unfulfilled. All the best and a very happy and prosperous New Year!!

AN Dec 8/17

Related Articles:

1. Extracurricular Activities are Important for Your Child!

2. Quit Smoking for a Healthy Life

3. Health Resolutions with Term Insurance Plan

Popular Searches

- Term Insurance Plan

- Term Insurance Age Limit

- Term Insurance with Maturity Benefit

- Term Plan in your 30s

- Term Plan Benefits

- Zero Cost Term Insurance

- Ideal Coverage Amount for Term Insurance

- Term Insurance Riders

- What is Term Insurance

- Types of Life Insurance

- Term Insurance with Return of Premium

- Group Life Insurance

- Saral Jeevan Bima

- Life Insurance Plans

- Benefits of Life Insurance

- Life insurance vs Health Insurance

- Life Insurance vs Annuity

- Types of Life Insurance

- What is Life Insurance

- Sum Assured

- Endowment Plans

- Health Insurance Plans

- Cancer Insurance

- Child Insurance Plans

- Cash Value Life Insurance

- Savings Plan

- Guaranteed Savings Plan

- Short Term Investment Plans

- Pension Plans in India

- ULIP Plan

- ULIP Meaning

- ULIP and Riders Options

- ULIP Plan Tax Benefit

- ULIP Benefits

- What is Annuity

:

:  :

: