About Aviva Smart Vitals

We all begin our fitness journey with enthusiasm — committing to exercise, eating right, and living better. Yet over time, motivation fades, and our health goals take a backseat. But what if your motivation never had to fade? What if it could become a routine that not only keeps you healthy but also secures your financial tomorrow?

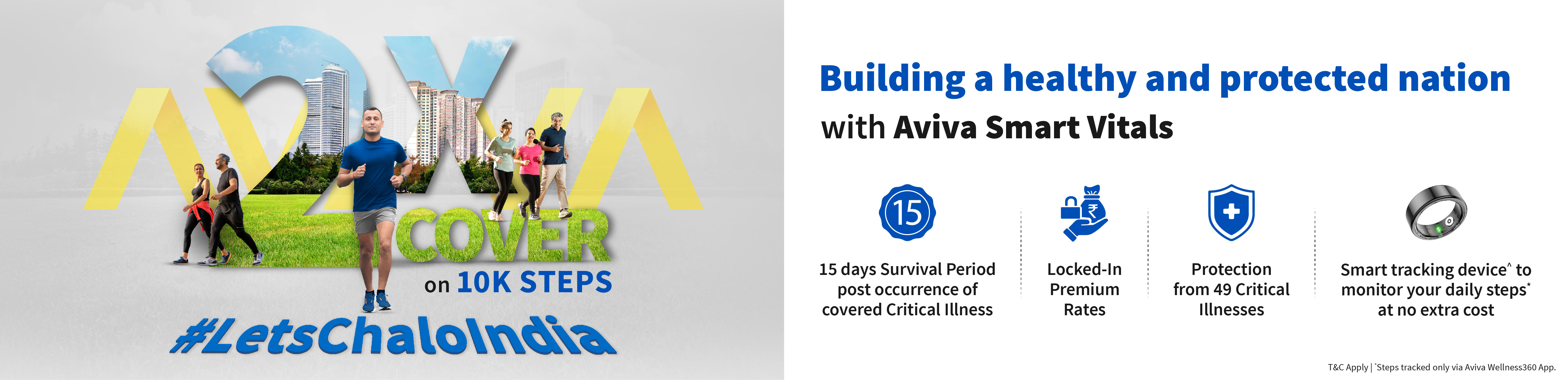

That’s where Aviva Smart Vitals comes in. More than just a health plan, it’s a partner in your wellness journey — rewarding your active lifestyle while safeguarding you against life’s uncertainties. With coverage against 49 critical illnesses, a Lump sum payout upon first occurrence, and the power to double your sum insured through step tracking on the Aviva Wellness360 app, this plan makes every move count. Add to that wellness addition, uniform premiums, and a shorter 15-day survival period for claims, and you get a health insurance solution that truly grows with you.

Unique Features of Aviva Smart Vitals

Double Sum Insured

Stay active, stay rewarded! With Aviva Smart Vitals, your daily steps not only keep you fit but also help double your sum insured.

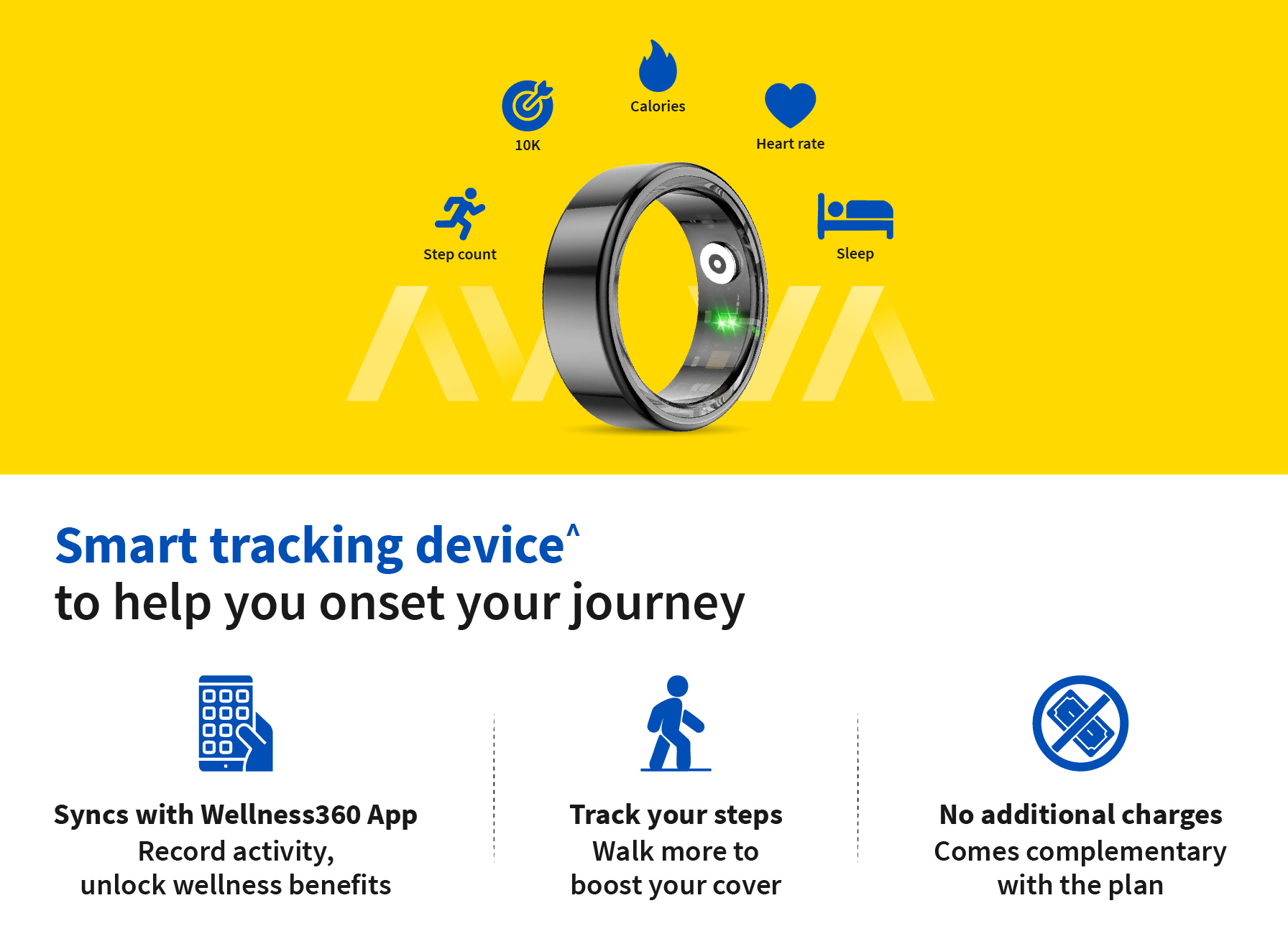

Smart Tracking Device

To promote a healthier lifestyle and facilitate step tracking available at no extra cost.

Access to Aviva Wellness360 App

Discover a smarter way to stay fit with Aviva Wellness360 App. Track your daily steps, sync with your health apps, and see your protection grow as you stay active.

Lumpsum Payout on Diagnosis

Get a lumpsum payout as soon as a critical illness is diagnosed—so you can focus on recovery, not expenses.

Short Survival Period

With a 15-day survival period, you become eligible for the benefit quickly. Get timely financial support when you need it the most.

Premium Remains Constant

The premium amount remains fixed for the entire policy term, ensuring that your payments are not affected by inflation. This provides long-term clarity and consistency in your financial planning.

What Does Aviva Smart Vitals Cover?

Aviva Smart Vitals is designed to provide financial protection in case of serious health conditions.

| What’s Covered | No. of Illnesses Covered | Benefit |

| Covers a wide range of critical illnesses, including cancer, heart attack, stroke, organ failure, neurological and autoimmune disorders. Full list below. |

49 Critical Illnesses |

Base Sum Insured ( ₹5/ ₹10/ ₹15/ ₹20/ ₹25 lakhs) + Wellness Additions, if any |

What is Not Covered?

The plan will not pay if:

- The illness occurs within the Waiting Period (90 days)

- You do not survive at least 15 days after the diagnosis.

- The illness existed before the policy started (unless previously accepted by Aviva).

- The illness results from self-harm, alcohol, drugs, or participation in hazardous activities.

- The illness is caused by war, riots, radiation, or criminal activity.

Please refer to Policy Terms & Conditions for detail.

Why Should You Buy Aviva Smart Vitals

-

Choose the Right Coverage for You

Aviva Smart Vitals Cover 49 critical illnesses, including cancer, heart conditions, kidney problems etc. You get a lump sum amount when you are diagnosed with a covered illness. This amount can be used for anything you need — treatment, daily expenses, or rest and recovery. -

Get a Fixed Payout When You Need It Most

If you are diagnosed with a covered illness and survive for at least 15 days after diagnosis, you will receive a lump sum amount. You don’t have to submit any hospital bills. Just the medical diagnosis is enough to get the benefit. -

Extra Coverage for Staying Active

Aviva Smart Vitals rewards you for walking regularly. If you walk daily, your coverage increases every quarter.Average steps per day in a quarter Wellness additions per quarter as % of the Base Sum Insured 5,000 to 8,000 steps 2.5%

8,001 to 12,000 steps 5.0%

More than 12,000 steps 7.5%

-

Protection That Fits Your Budget Annual Premiums are based on your age and gender. Annualized Premiums start as low as:

- ₹4,625/year for men

- ₹4,800/year for women

-

Simple Plan for Fixed Term

- Policy Term: 5-30 years (in running numbers)

- Premium Paying Term: Regular pay, equal to the Policy Term

- Base Sum Insured: ₹5/ ₹10/ ₹15/ ₹20/ ₹25 lakhs (can grow with step rewards)

-

Easy Claim and Policy Revival Process

- There is a 90-day waiting period from the start of the policy or its revival, whichever is later.

- You must survive 15 days after the diagnosis to receive the benefit.

- If the policy lapses, you have 5 years to revive it by paying all dues with interest (9% per annum compounded monthly plus taxes).

Note: The increase in your sum insured is based only on the average steps you achieve per day in a quarter. The percentage shown (2.5%, 5%, or 7.5%) is a single benefit applied according to your step range. It is not added together across different step ranges. For example: If you walk more than 12,000 steps a day on average in a quarter, your sum insured will increase by 7.5% only, not 7.5% + 5% + 2.5%.

Eligibility

| Parameters | Minimum | Maximum |

|---|---|---|

| Entry Age | 20 Years of age as of last birthday | 60 Years of age as of last birthday |

| Maturity Age | 25 Years | 65 Years |

| Policy Term | 5 to 30 Years | |

| Premium Payment Term | Regular Pay, equal to Policy Term | |

| Base Sum Insured | ₹5/ ₹10/ ₹15/ ₹20/ ₹25 Lakh Per life | |

| Premium Payment Mode | Annual/ Semi-Annual/ Quaterly/ Monthly | |

| Annualized Premium* | Male: ₹4,625/- Female: ₹4,800/- |

Male:₹1,19,056/- Female: ₹1,12,278/- |

*Taxes, if any, shall be payableas per the applicable tax laws, as amended, from time to time.

Premium Range

| Gender | Starting Annualized Premium | Maximum Annualized Premium |

|---|---|---|

| Male | ₹5,421 | ₹30,660 |

| Female | ₹5,818 | ₹29,703 |

Aviva Smart Vitals-Buying Process

Step 1. Customers apply through multiple lead-generation channels (online, agents, partners, etc.).

Step 2. Post risk assessment, the policy is issued.

Step 3. Once the policy is issued, the Smart Tracking Device is automatically dispatched to the registered address within 7 days.

Step 4. After policy commencement, the customer is prompted to download the Aviva Wellness360 health & wellness app.

Step 5. Customer links their existing mobile health app (e.g., Apple Health, Google Fit) with Aviva Wellness360.

Step 6. Daily steps tracked in their mobile health app sync automatically with Aviva Wellness360. Sync meaning – Customer has to open Aviva Wellness360 app to sync health app for steps transfer.

Step 7. Based on the average step count in Aviva wellness360 App, the sum insured increases every quarter.

How Can You Buy the Plan?

You can speak with an Aviva advisor or purchase the plan online. You’ll need to complete a quick identity check (Video KYC). For step tracking, a device or app may be provided when the policy starts.

How it Works?

“Stride Towards Bigger Benefits”

Buy your policy and get it issued after a quick risk check

Your smart tracking device will arrive at your doorstep within 30 working days at no extra cost.

Activate Aviva Wellness360 and connect it with your health app.

Walk daily, sync your steps, and watch your cover grow every quarter!

About Aviva Wellness360 App- Your Health Partners

Aviva Wellness360 is your all-in-one digital health companion — designed to help you take charge of your wellbeing with smart tools for proactive health checks, fitness tracking, and personalized wellness insights.

Experience holistic wellbeing with these powerful features:

![]() Hit your daily step goals to earn rewards and boost your sum insured.

Hit your daily step goals to earn rewards and boost your sum insured.

Get an AI-powered health report instantly with a quick facial scan.

Get an AI-powered health report instantly with a quick facial scan.

Enjoy a customizable AI diet planner designed for your health goals.

Enjoy a customizable AI diet planner designed for your health goals.

An all-in-one wellness app that blends fitness with financial benefits.

An all-in-one wellness app that blends fitness with financial benefits.

Frequently Asked Questions

Product Related FAQs

Claims Department

Aviva Life Insurance Company India Ltd.

401-A, 4th Floor,

Block A, DLF Cyber Park,

Sector-20, NH-8, Gurugram,

Haryana – 122016, India.

Aviva Smart Vitals plan provides Wellness Benefits in terms of simple additions in the Base Sum Insured on regular walking by the life insured.

The Base Sum Insured increases every quarter, based on your daily average step count as shown in the table below. To be eligible, you must also remain active for at least 60 days in a quarter (i.e., recording more than 0 steps in 60 days).

| Tier | Average Steps per day in a Quarter | Wellness Additions per Quarter as % of the Original Sum Insured |

| Pacer | >=5000 but <=8000 | 2.50% |

| Achiever | >=8001 but <=12000 | 5.00% |

| Champion | >=12001 | 7.50% |

Disclaimer: The increase in your sum insured is based only on the average steps you achieve per day in a quarter. The percentage shown (2.5%, 5%, or 7.5%) is a single benefit applied according to your step range. It is not added together across different step ranges. For example: If you walk more than 12,000 steps a day on average in a quarter, your sum insured will increase by 7.5% only, not 7.5% + 5% + 2.5%.

A user’s eligibility to double the sum insured depends on their average daily steps each quarter. The cover grows gradually every year based on the step range achieved until it reaches twice the original amount.

- If a user averages 5,000–8,000 steps per day, the sum insured increases by 2.5% per quarter, reaching double (Rs. 20L) by end of Year 10.

- If a user averages 8,001–12,000 steps per day, the sum insured increases by 5% per quarter, reaching double (Rs. 20L) by end of Year 5.

- If a user averages 12,001+ steps per day, the sum insured increases by 7.5% per quarter, reaching double (Rs. 20L) by the end of 2.6 Years.

- If a user averages below 5,000 steps per day, no additions apply, and the sum insured remains unchanged.

Disclaimers:

- Once the sum insured has increased, it will remain at that level, regardless of whether step targets are met in future quarters.

Aviva Wellness360 App Related FAQs

To download and set up the Aviva Wellness360 app, please follow these steps:

- Download the App

- Go to the Google Play Store (for Android) or the App Store (for iOS).

- Search for “Aviva Wellness360 app” and tap Install.

- Once installed, open the app.

- Register for the First Time

- Enter your mobile number (this will be your primary identifier).

- Provide consent by accepting the Terms & Conditions and Privacy Policy.

- Complete OTP verification via SMS or email.

- Connect Your Device

Services Related FAQs

- Make sure the Google Health Connect / Apple Health application is installed in your phone and is connected to the Aviva Wellness360 application.

- Check your internet connection; the step syncing requires the phone to have an active internet connection. Try restarting the application after force stopping it in the settings.

Please note, the Aviva Wellness360 application syncs with your phone's native health application (Google Fit/Apple Health) and the steps on the app will be the same as the health app.

AN Feb 58/26 | UIN122N159V02

Disclaimer:

:

:  :

: