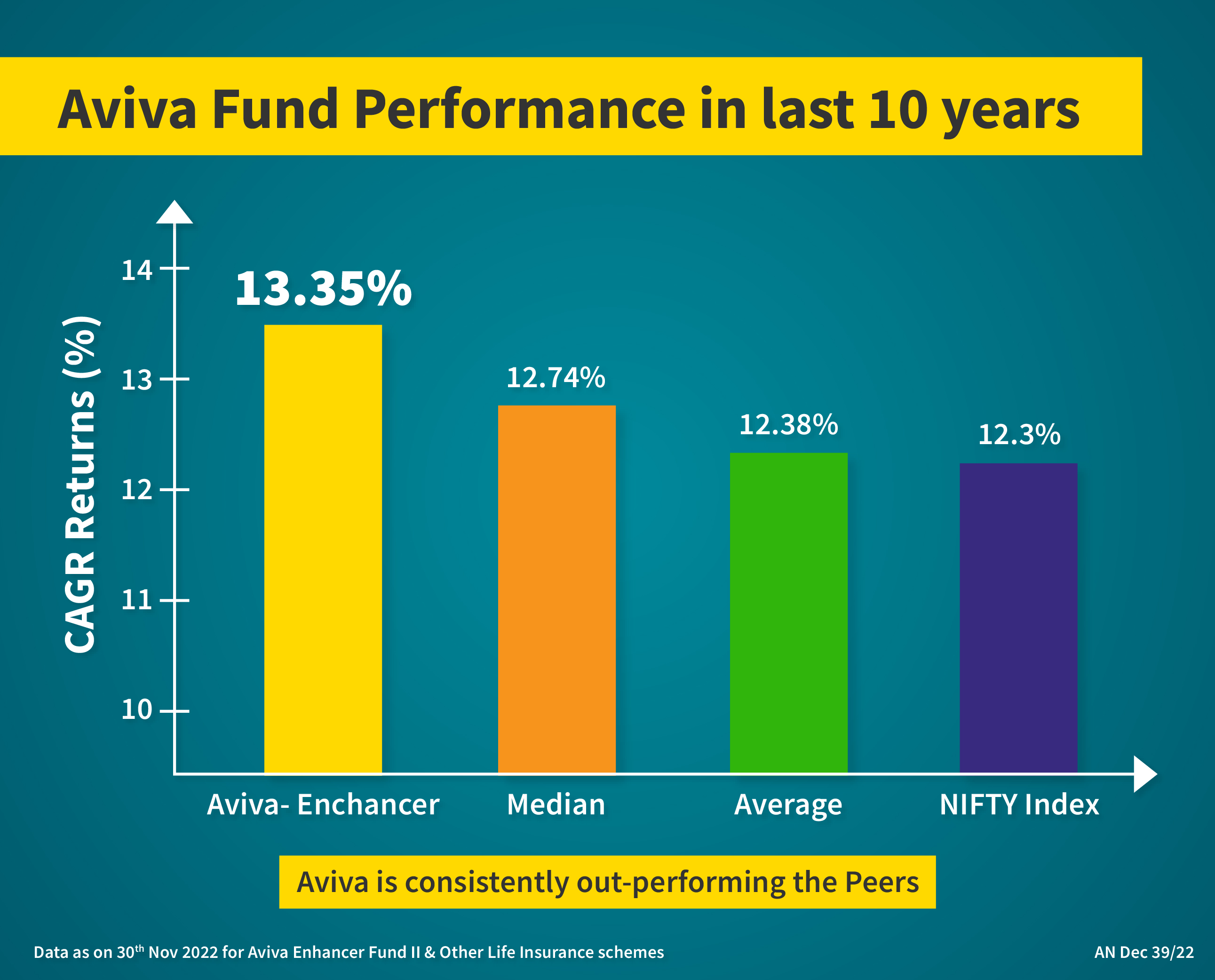

The Steadiest vehicle leading to high returns in the long run

Regular and Long-Term Investment in Aviva ULIPs is the key to unlock best returns from the Indian market. Get high returns by making small investments today and sow the seeds of the financially secured future with Aviva Signature Investment Plan.

Tax benefits on Premiums Paid up to ₹ 1.5 Lacs

Policy allocation charges

Upto 100% return of charges* at Maturity

in case of death

*All charges except fund management charges